It is a very vital document since it is a legal compliance and any misreporting or wrong reporting in the ITR form can lead to serious consequences which includes heavy fines and penalties.

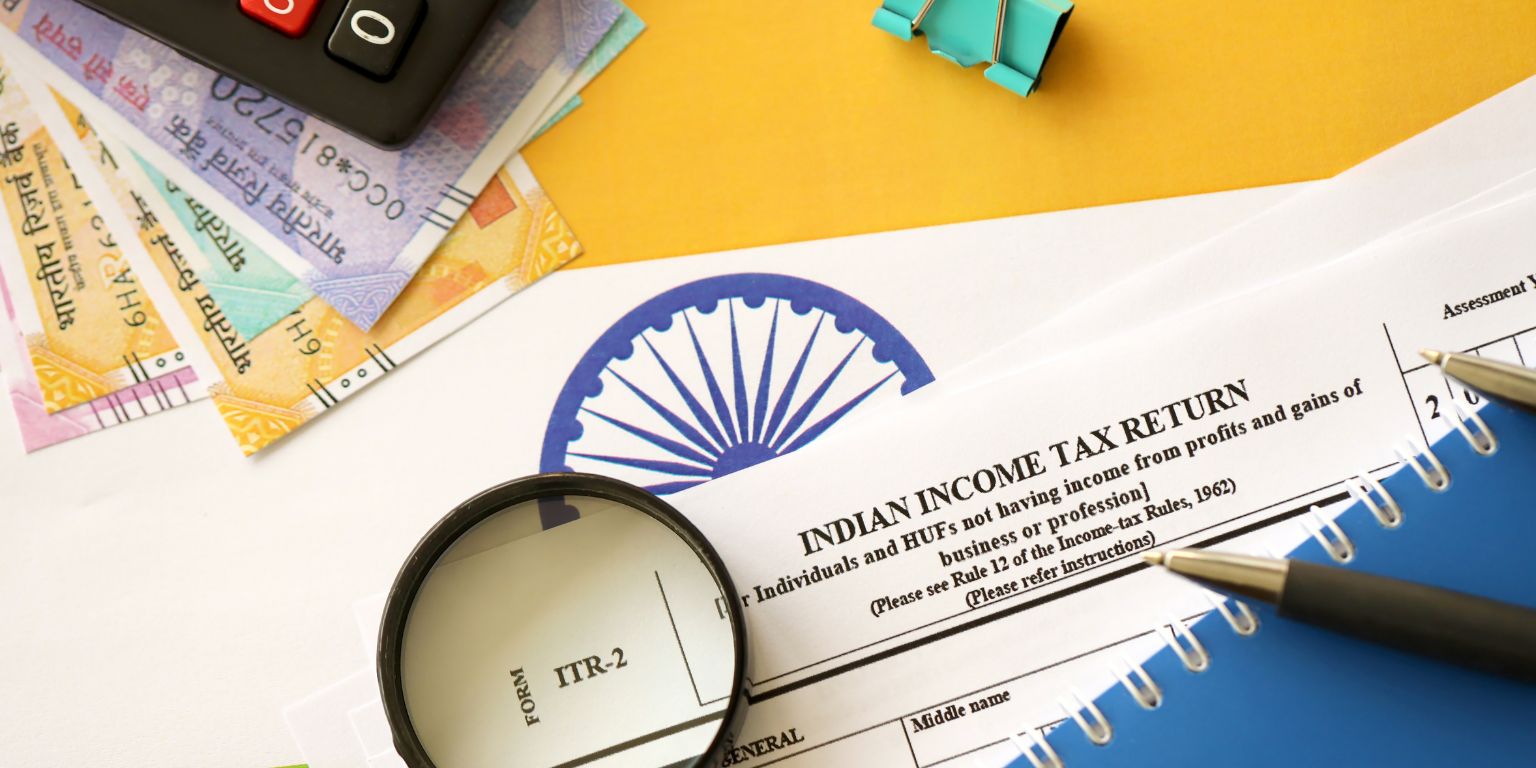

1. Wrong ITR Form

There are different ITR forms for different type of persons and for different types of income. Therefore, choosing the correct ITR form is very important. Using an incorrect ITR Form (like ITR-1 instead of ITR-3) can lead to your ITR being declared as defective or liable to rejection.

2. Not reporting Interest Income

All kinds of income from other sources have to be reported while filing your ITR. One of the common mistakes which people do is to not report or under report their interest income. All kinds of interest income from Savings Bank A/c, Fixed Deposits, Recurring Deposits or bonds etc. must be reported while filing ITR. A common misconception with people is that Post Office Deposits are exempt from Income Tax. It is not true. Interest on all deposits are liable to Income Tax except otherwise specifically exempted by the Income Tax Law.

3. Ignoring data from Form 26AS / AIS / TIS

It is very important to take into consideration the income and other data which is contained in Form 26AS / AIS / TIS. These are forms which contain incomes or other financial information as reported by various financial and other institutions.

For example : Interest Income, Tax Deducted at Source, Sale or Purchase of Shares and Mutual Funds, Sale or Purchase of immovable property, Salary Income etc.

Reconciling the income between your ITR and these forms is vital before filing your ITR, since any kind of mismatch or under reporting might invite income tax notices or scrutiny.

4. Not disclosing foreign assets or Income

Indian Residents are required to disclose their foreign accounts or assets or foreign incomes (including accounts where they only have signing authority) in their ITR. Many people skip these disclosures, thus inviting serious penalties under the Black Money Act.

5. Claiming incorrect deductions (80C, 80D, etc.)

Certain deductions are allowed from total income of an assessee under the Old Tax Regime of the Income Tax Laws. These include deductions u/s 80C, 80D, 80EE, 80G, Housing Loan Interest u/s 24(b) etc. Many people claim ineligible expense or investment as deduction under these sections or they over claim these deductions without having sufficient proof for such deductions. For Example – Claiming deductions without actually making such eligible expenditure or investment.

Under the New Tax Regime, no deductions are allowed, except a very few. Some people claim ineligible deductions under New Tax Regime to reduce their tax liability.

All such over-claims or false/ bogus claims of deductions are serious offences under the tax laws and may attract disallowances during scrutiny which would lead to payment of tax along with heavy interest. Also, heavy penalties may be imposed for such misreporting or under-reporting.

For A.Y. 2024-25, many assessee who have claimed heavy deductions have started receiving notices u/s 143(2) for scrutiny assessments.

6. Not reporting Capital Gains Disclosure

People often think that capital gains arising from sale of property, shares, mutual funds or crypto assets are not chargeable to tax. There are many myths associated with it. Some think that it was my ancestral property therefore I do not have to pay tax on the gains earned on sale. Some think that my gain is not substantial enough to be reported.

Some think that tax is already deducted on the sale transaction therefore I need not report and pay tax on it while filing ITR. However, all these points are totally false. Any gains or income earned are to be reported and tax has to be paid on them except otherwise exempted by tax laws.

7. Thinking that TDS deducted by employer covers all the tax liability

There is a huge misconception that if my employer has deducted tax from my salary income then I do not have to pay any more tax. This false impression lands many salaried employees under huge trouble and tax burden.

Your employer is responsible to deduct tax only on the salary which he pays. He is not responsible for deducting tax on the salary paid to you by previous or any other employer, or tax on your any other income.

Your ITR takes into account not only your salary income but other incomes also. While preparing ITR, your total income is computed by adding your salary income, house property income, capital gains, income from other sources such as interest etc. and resultant tax is calculated on this total income. Tax deducted by your employers on salary income and TDS, if any, on other incomes is adjusted from this total tax and you have to pay the balance tax.

Ignoring other incomes while calculating your annual tax estimates might result in additional tax burden while filing ITR and also interest for not paying Advance Tax.

8. Delaying Filing of ITR or Missing Due Dates for ITR

Not filing your ITR within the due dates will attract:

- Late fees upto Rs. 5000/- u/s 234F.

- Interest u/s 234A, 234B.

- Inability to carry forward capital losses and business losses.

9. Compulsory Filing in certain cases

A person must file ITR in certain cases irrespective of whether you have tax payable or not. A person should compulsorily file his ITR if his income before allowable deductions is more than maximum income not chargeable to tax (Basic Exemption Slab) i.e. Rs. 4 Lakhs under New Tax Regime for A.Y. 2026-27.

For example, you have income of Rs. 5 lakhs, there is no tax payable on it after rebate u/s 87A, but filing of ITR with NIL tax is compulsory since your Income is more than basic exemption slab i.e. Rs. 4 Lakhs.

There are certain cases where filing is compulsory even if your income is below the basic exemption slab. These are covered under 7th proviso to Section 139(1) :

- Aggregate of current account(s) deposits exceeding Rs. 1 crore

- Aggregate of foreign travel expenditure exceeding Rs. 2 lakhs

- Aggregate of electricity expenditure exceeding Rs.1 lakh

- Total sales, turnover or gross receipts, in the business exceeds Rs. 60 lakhs during the previous year.

- Total gross receipts in profession exceeds Rs. 10 lakhs during the previous year.

- The aggregate of TDS and TCS during the previous year, is Rs. 25000 or more.

- If total deposits in a savings bank account are Rs. 50 Lakh or more, in the previous year.